As a business owner, you might be required to file Expanded Withholding Tax.

But not all taxpayer are aware if they need to file Expanded Withholding Tax. As a result they get penalized for not knowing.

The reason why I wrote this article is for you to understand the importance of Expanded Withholding Tax so that you will avoid paying unnecessary penalties.

In this article, you’ll learn about:

- What is Expanded Withholding Tax (EWT)?

- What will happen if the Withholding Agent fails to Withhold Taxes?

- Who are required to File and Pay Expanded Withholding Tax?

- What are the Income Payments and Tax Rate subject to Expanded Withholding Tax?

- When, Where to File and Pay Expanded Withholding Tax?

- What is Quarterly Alphalist of Payees (QAP)?

- Who are exempted from Expanded Withholding Tax?

After reading this article, you will get an overview of Expanded Withholding Tax in the Philippines under TRAIN Law.

1. What is Expanded Withholding Tax (EWT)?

Expanded Withholding Tax (EWT) is a kind of tax that is taken in advance by the buyer (withholding agent) from the seller’s income, on behalf of the government.

If you’re a withholding agent, you’re required to collect withholding tax on behalf of the government, in order to avoid unnecessary penalties.

The tax withheld is used as a deduction to the Income tax of the seller.

2. What will happen if the Withholding Agent fails to Withhold taxes?

If the withholding agent fails to withhold expanded withholding tax, he/she will need to pay penalties amounting to:

- 25%-50% surcharge based on tax unpaid

- 12% annual interest based on tax unpaid

- Compromise Penalty P1,000 – 25,000 every time you fail to withhold

3. Who are required to File and Pay Expanded Withholding Tax?

Not everyone is a withholding agent. You will be a Withholding Agent only if your payment is included in the list of Income Payments subject to Expanded Withholding Tax.

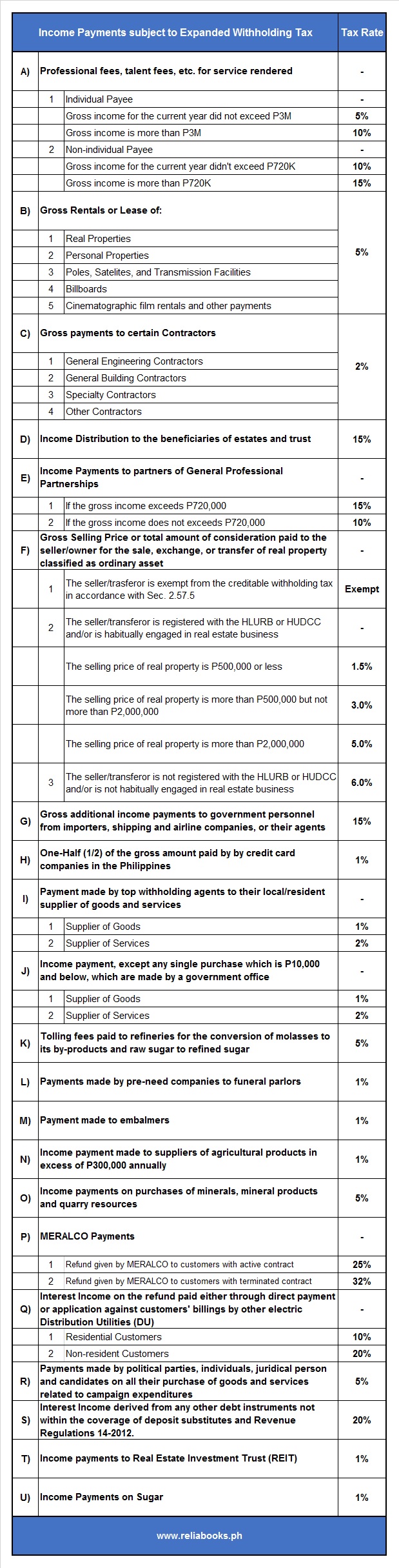

4. What are the Income Payments and Tax Rate subject to Expanded Withholding Tax?

5. When, Where to File and Pay Expanded Withholding Tax?

Before the Implementation of Train Law on January 2018, taxpayers file Expanded Withholding Tax (EWT) on or before the 10th of the following month and on or before Mar. 1 using BIR Form No. 1601E and BIR Form No. 1604E, respectively.

After the implementation of TRAIN LAW, here are the Forms you need to file:

a. Monthly Remittance Form of Creditable Income Taxes Withheld – Expanded (BIR Form No. 0619E)

This shall be filed and remitted on or before the 10th of the following month in which withholding was made. This shall be filed for the first 2 months of each quarter.

b. Quarterly Remittance Form of Creditable Income Taxes Withheld – Expanded (BIR Form No. 1601EQ)

This quarterly withholding tax remittance return shall be filed and remitted along with Quarterly Alphalist of Payees (QAP) not later than the last day of the month following the close of the quarter during which withholding was made.

c. Certificate of Creditable Tax Withheld at Source (BIR Form No. 2307)

This return is the proof that you withhold expanded tax from the seller. You give this to your seller either every 20th day following the close of the taxable quarter or upon request of the payee.

The Seller will attached this form when they file their Income Tax Return (ITR) to minimize the tax they need to pay.

d. Annual Information Return of Creditable Income Taxes Withheld (BIR Form No. 1604E)

This return shall be filed on or before March 1 of the year following the calendar year in which the income payments subjected to expanded withholding taxes.

Here is the summary of what you might need to file every Quarter:

1st Month of the Quarter – File BIR Form No. 0619E

2nd Month of the Quarter – File BIR Form No. 0619E

3rd Month of the Quarter – File BIR Form No. 1601EQ and QAP

On or Before Mar. 1 after the taxable year – File BIR Form No. 1604E

These returns shall be filed through Electronic Bureau of Internal Revenue Forms (eBIRForms) or Electronic Filing and Payment System (eFPS).

And shall be paid through eFPS or Authorized Agent Bank (AAB) of the Revenue District Office (RDO) where the taxpayer is registered and conducting business.

A taxpayer may file a separate form for the head office and for each branch or place of business/office or a consolidated form for head office and all the branches/offices.

In the case of large taxpayers, only one consolidated form is required.

6. What is Quarterly Alphalist of Payees (QAP)?

This is an alphabetical list of all taxpayers where you withhold expanded withholding taxes (EWT) with.

You file this as an attachment to BIR Form No.1601EQ using BIR Alphalist Data Entry and Validation Module which you can download in the website of BIR.

After Data Entry and Validation of QAP, you need to email it to esubmission@bir.gov.ph.

After that, you will received email confirmation from the BIR that the report you submit is correct.

Print the email confirmation as proof that you filed on time.

7. Who are exempted from Expanded Withholding Tax?

Withholding of Expanded Withholding Tax shall not apply to income payments made to the following:

A. National government and its instrumentalities, including provincial, city, or Municipal governments.

B. Person enjoying exemption from payment of Income Tax

Updates:

According to RR 1-2019,

A. The tax rate of Meralco Payments is changed from 25% to 15%.

B. The tax rate of Interest Income on the refund is changed from 20% to 15%.

This is received by the Record Management Division of the BIR on Feb 8, 2019.

References:

a. Implementing Republic Act No. 8424 (RR 2-1998)

b. Amendments Introduced by TRAIN Law Relative to Withholding of Income Tax (RR 11-2018)

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can contact us here.