This guide is for business owners, professional, accountants, bookkeepers, students who want to learn how to learn how to compute Income Tax Withheld on Compensation under TRAIN Law.

After reading this guide, you will learn:

1. What is the Formula in Getting the Employee’s Taxable Compensation?

2. What are included in the Total Amount of Compensation?

3. What are Included in Non-Taxable/Exempt Compensation?

4. How to Get the Prescribed Withholding Tax of every Employees?

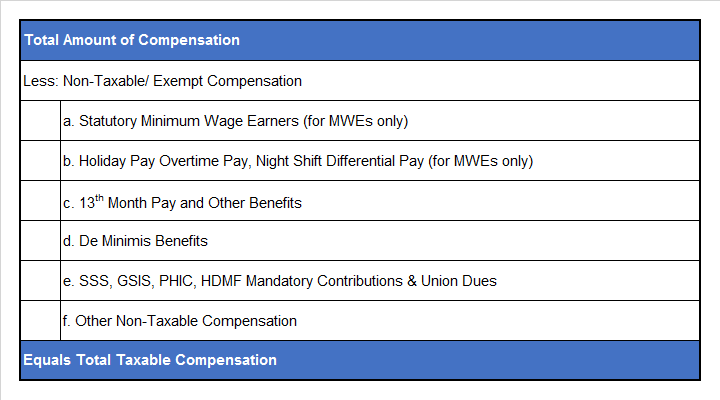

1. What is the Formula in Getting the Employee’s Taxable Compensation?

Below is the formula in getting the Employee’s Taxable Compensation:

2. What are included in the Total Amount of Compensation?

Compensation means all remuneration for services performed by an employee for his employer under an employer-employee relationship.

This includes Salaries, Wages, Board and Lodging Allowances, Transportation Allowances, Commissions, Bonuses, Overtime Pay, Tips and Service Charge, Employer’s SSS, PHIC, and HDMF Contributions and other compensation Income exempted from Withholding Tax

3. What are Included in Non-Taxable/Exempt Compensation?

The following income payments are exempted from the requirement of withholding tax on compensation.

These are the items that you deduct after you add it in the Total Compensation Income:

1. Remunerations received as an incident of employment like Retirement Benefits

2. Remuneration paid for agricultural labor

Agriculture labor does not include services performed in connection with forestry, lumbering, or landscaping.

3. Remuneration for services of a household nature performed by an employee in or about the private home of the person he is employed is not subject to withholding.

4. Remuneration for casual labor not in the course of employer’s trade

5. Compensation for services by a citizen or resident of the Philippines for a foreign government or an international organization.

6. Damages like Actual, moral, exemplary and nominal damages received by an employee or heirs arising out of or related to employer-employee relationship.

7. Life Insurance

8. Amount received by the insured as a return of premium

9. Compensation for injuries or sickness

10. Income exempt under treaty

11. Thirteen 13th month pay and Other benefits not exceeding P90,000.

a. Thirteen month pay

b. Other benefits such as Christmas bonus, Productivity Incentive Bonus, Loyalty Award, gift in cash or in kind, and Additional Compensation Allowance (ACA)

Included in the Other Benefits are the De Minimis Benefits.

12. GSIS, SSS, Medicare and other contributions

Included in the Other Contributions are the Employer’s Philhealth and Pag-Ibig Contribution.

13. Compensation Income of Minimum Wage Earners (MWEs)

a. Statutory Minimum Wage (SMW)

b. Holiday Pay

c. Overtime Pay

d. Night Shift Differential Pay

e. Hazard Pay

Holiday Pay, Overtime Pay, Night Shift Differential, Hazard Pay will be tax exempt only if the Employee is a Minimum Wage Earner.

14. Compensation during the year not exceeding Two hundred Fifty Thousand Pesos (P250,000)

4. How to Get the Prescribed Withholding Tax of every Employees?

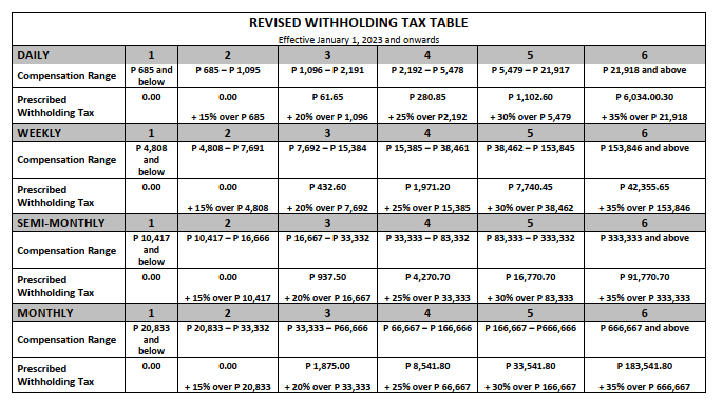

The Taxable Compensation of each employee is the Compensation Range you will use to get the Prescribed Withholding Tax in the Revised Withholding Tax Table.

Computations can be done Daily, Weekly, Semi-Monthly, or Monthly basis.

a. Use Annex D of RR 11-2018 effective January 1, 2018 to December 31, 2022.

b. Use Annex E of RR 11-2018 effective January 1, 2023 and onwards.

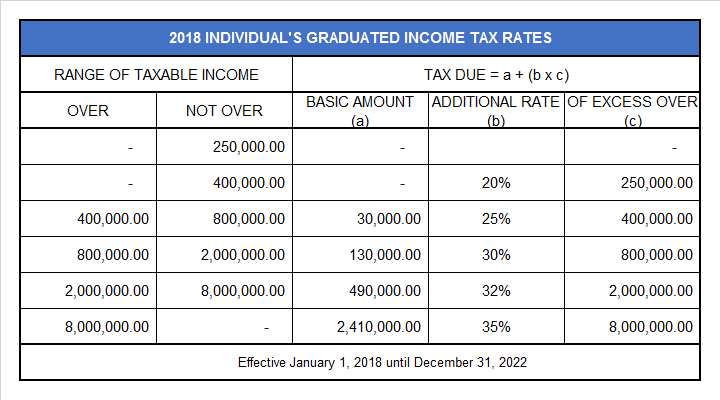

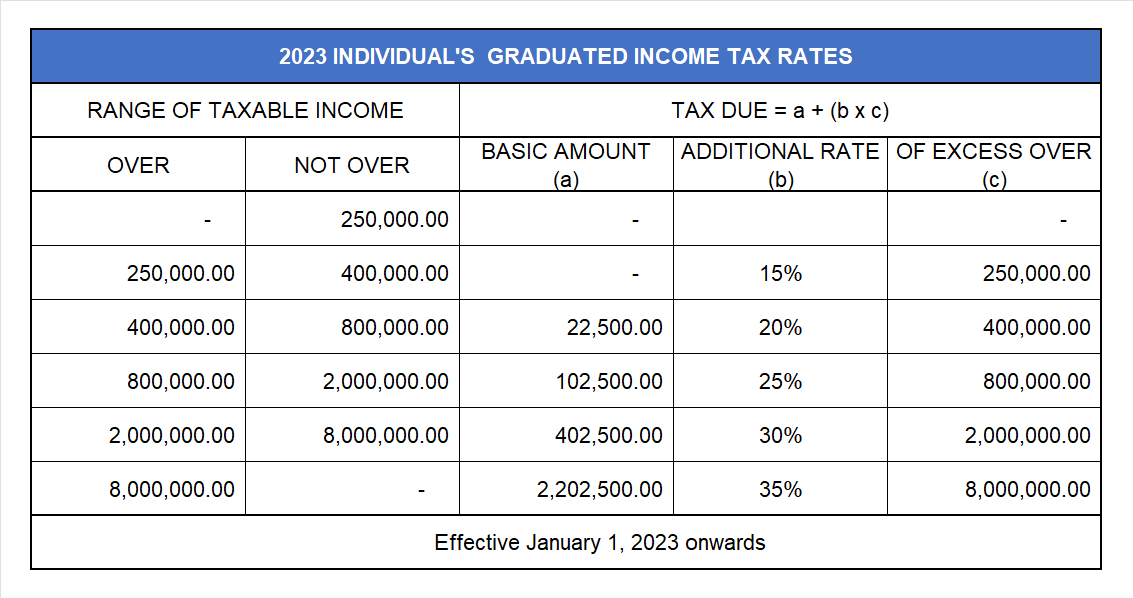

At the end of the year, the tax withheld by the employer must be equal to tax due of the employee. You can compute employees tax due using the Individual’s Graduated Income Tax Rate.

a. For Income earned for taxable years 2018 to 2022, use the 2018 Individual’s Graduated Income Tax Rate Table.

b. For Income Tax earned for taxable years 2023 and onwards, use the 2023 Individual’s Graduated Income Tax Rate Table.

References:

a. Republic Act 10963 (Train Law)

b. Implementing Republic Act No. 8424 (RR 2-1998)

c. Amendments Introduced by TRAIN Law Relative to Withholding of Income Tax (RR 11-2018)

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can Contact us here.