Every taxpayer engaged in trade or business are required to issue BIR registered Sales Invoice and Official Receipt for each sale of goods or services.

Issuing a BIR Sales Invoice and/or Official Receipts will:

- Save you from paying penalties and

- Increase your sales by attracting companies to buy in bulk from you

If you want to learn the difference between Sales Invoice and Official Receipt and avoid paying unnecessary penalties, this article will be beneficial for you. The first thing you need to know is:

Invoices and/or Receipts are classified into two (2). These are:

- Principal Invoices/Receipts

- Supplementary Invoices/Receipt

A. PRINCIPAL Receipt Invoice includes:

- Sales Invoices,

- Official Receipts

What is the Difference between Sales Invoice and Official Receipt?

1. Sales Invoice

Sales Invoice is good as Official Receipt.

Sales Invoice is use for sale of goods and/or properties.

Example of business that issue Sales Invoice are Food Kiosk (Take-Out) and Retail stores like hardware and drugstores.

Cash Sales Invoice and Charge Sales Invoice fall under this definition.

Additional Tip:

For people who also sell on account (credit), it’s better if you have three (3) Invoice and Receipts:

- Cash Sales Invoice and

- Charge Sales Invoice (credit)

- Collection Receipt (supplementary receipt)

Cash Sales Invoice is a written admission that money has been paid and received for the payment of goods and/or properties.

Charge Sales Invoice is issued when your goods and/or properties are sold on account (credit).

Once you received the payment for selling your goods and/or properties on account (credit), you need to issue a supplementary receipt called Collection Receipt.

2. Official Receipt

Official Receipt is use for sale of service and/or leasing of properties..

Examples of business that issue Official Receipt are Restaurants (Dine-in) and Professionals like accountants, doctors, lawyers, and graphic artist.

When you’re engage with sale of services and/or leasing of properties, it’s not necessary to issue sales invoice. This is to avoid double taxation.

In addition to the Official Receipt, you may use a supplementary receipt called Acknowledgement Receipt if the money you received is not intended for you and you’re transparent with your cost.

Doing this will lower your tax liabilities as a service provider. Good example of this is SM Bills Payments.

B. SUPPLEMENTARY Receipts/Invoices

These are also known as COMMERCIAL INVOICES.

It is a written account evidencing that a transaction has been made between the seller and the buyer of goods and/or services, forming part of the books of accounts of a business taxpayer.

Examples of Supplementary Receipts/Invoices are Delivery receipts, Order slips, Debit memo, credit memo, Purchase order, Job order, Provisional/temporary receipt, Acknowledgement receipt, Collection receipt, Cash receipt, Bill of lading, Billing statement, Statement of account.

For purposes of Value Added Tax (VAT), these supplementary receipts/invoices are not valid proofs to support the claim of Input Tax by the buyer of goods and/or services.

All Supplementary Invoices must be registered in BIR in order to avoid penalties.

What are the Invoicing Requirements when it comes to VAT?

1. The amount of VAT shall be shown as a separate item in the invoice or receipt

2. If the Sale is exempt from VAT, the amount of VAT-exempt sale shall be written or printed prominently on the invoice or receipt.

3. If the sale is subject to zero percent (0%) VAT, the amount of zero-rated sale” shall be written or printed prominently on the invoice or receipt.

What are the consequences if a VAT-Registered Person fails to display prominently on the invoice or receipt the words “VAT-Exempt sale” on Exempt Transaction?

1. The transaction shall become taxable and the issuer shall be liable to pay VAT thereon.

2. The purchase shall be entitled to claim an input tax credit on his purchase.

How to Avoid BIR Tax Penalties?

In order to avoid BIR Tax Penalties, you need to know the rules.

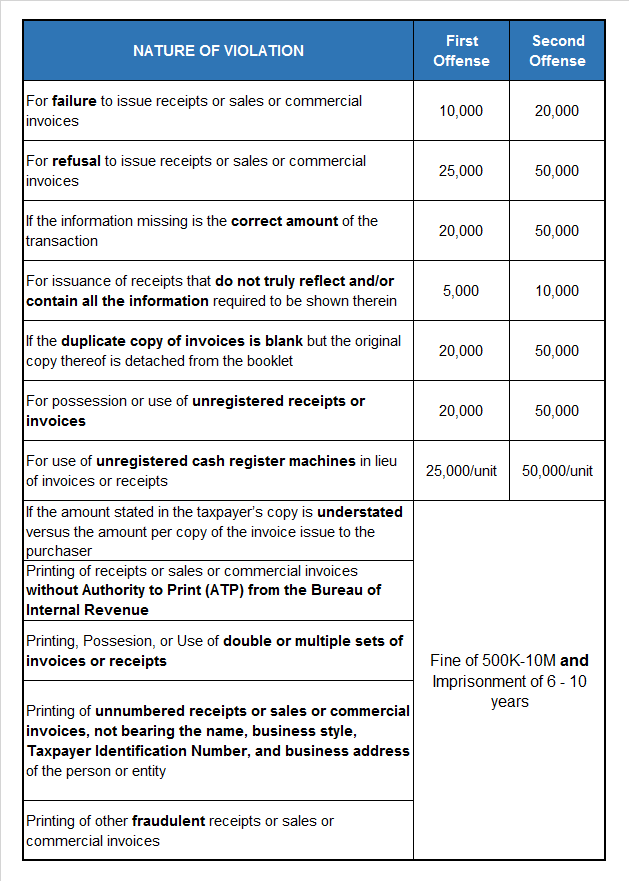

Here is the summary of mistakes and penalties of the business owner regarding issuing of Sales Invoice and Official Receipt.

(Sec. 264 of the NIRC and Sec. 77 of the Train Law)

Seven (7) IMPORTANT REMINDERS

Here are the important reminders when it comes to Sales Invoice and Official Receipts:

1. Secure from the BIR an Authority to Print (ATP)

Please note that only BIR accredited printers are allowed to print BIR receipts and commercial invoices. ATP is needed before the BIR accredited printer can print your receipts or sales or commercial invoice.

2. Each head office and branches must have its OWN sales invoice and official receipts.

Each establishment is designated with special codes that can be seen in the last three (3) digits of the tax identification number (TIN).

3. Always issue a Sales Invoice and Official Receipt.

The total Sales Invoice and Official Receipt will be the basis of what you will put in your Books of Accounts and Tax filing.

4. Fill up all information

As much as possible, fill up all information required in the Sales Invoice and Official Receipt. Especially when you’re a VAT Taxpayer.

5. The Validity of Sales Invoice and Official Receipts are only five (5) years.

The taxpayer should secure an Authority to Print (ATP) sixty (60) days prior to its renewal or before the Sales Invoice and Official Receipt are fully consumed.

6. Do not fill up the last Sales Invoice and Official Receipt booklet.

This is one of the documentary requirements you give when securing an Authority to Print (ATP) to the BIR.

Depending on the demand, Printing of Sales Invoice and Official Receipt can take from 1 month to 2 months.

Consuming the last booklet while waiting for new Sales Invoice and Official Receipt to be printed is an evidence that you’re not issuing or you refuse to issue Sales Invoice and Official Receipt.

7. Ask question to your accountant.

Learning is one of the benefits of getting an accountant. Other from that, they help entrepreneurs make better decisions, have more time, have peace of mind, and avoid incurring unnecessary penalties.

(Train Law; RR No. 18-2012; RMO 7-2015)

There you go, I hope that you learn something in this article that can save you from unnecessary tax penalties.

If you have questions regarding tax, accounting, and business registrations, you can contact us here.

You can also visit and like our Facebook Page for important updates and upcoming live training.

hello po, furniture po ang business namin. may I ask if pagdating po sa sales invoice. customer po dapat ang pipirma tama po? kasi ung mga tao po namin ang pumipirma sa sales invoice.

Hi Arveeeyz,

Dapat yung staff niyo po ang pipirma.

Hi, If the sales of goods has delivery fees, do I need to split the items as Sales Invoice and the Delivery Fee as OR?

Hi ask ko lang po kapag nagissue po ba ng cash sales invoice no need na po ba magissue ng collection receipt ? Thanks

Hello Angie,

Kapag Cash Sales Invoice ang inissue mo. Hindi mo na kailangan mag issue ng Collection Receipt.

I am a millennial and quite ashamed that I am 20 and didn’t know the difference betweeen the two. I wish these things are taught in schools. I have very little accounting background. But I am always grateful to learn. Thanks po for sharing.

Hi Millennial Girl,

Don’t be ashamed. Si lola ko, matanda na, hindi pa din niya alam difference ng dalawa.

Bata pa tayo, kaya madami pa time mag aral.

Salamat sa pag share ng thoughts mo 🙂

Ito ang weakness ko Jude. Meron akong business dati, nagpaprint na ako ng charge invoice and receipts tapos na-hire ako mag-work at napabayaan ko na business ko. Ngayon gusto kong ayusin ang BIR docs ko for my consultation services pero sabi nila may penalty daw ako kasi hindi ko pa na-close iyong old business ko and if I remember it right, 30k+ iyong penalty ko. I wasn’t even aware of the “closing” thing kasi. Akala ko pag nagsara, iyon na iyon. What do you suggest?

Hi Mother Ant.

Ang dami ko ganyan case na hinandle. P100K+ halos yung open case or penalties nila.

Kailangan talaga bayaran, if gusto mo ma clear ang name mo in the BIR.

Sa ngayon, pinaka maganda gawin ay:

1. Mag file ka ng tax return na mag cover ng current at future months, kahit zero lang ang sales.

Ang purpose nito ay para hindi na dumami ang penalties mo.

2. Tapos, mag request or patulong ka sa BIR. Sabihin mo na gusto mo mag bayad ng penalty on installment basis.

Purpose nito ay para mabawasan ang penalties mo. At ma close ang business in the future.

3. Kung gusto mo makasave ka ng time, Maganda kung makakita ka ng trusted bookkeeper na malapit sa inyo.

May tax computation, filing, and payment pa kasi ang magaganap.

Wow! Salamat, this is very informative.

You’re welcome Chelle 🙂

Thanks for the information. Before reading this, I thought they are just the same.

Now I know their difference and importance.

Hi Kamille. You’re welcome.

Ako din dati, akala ko, pareparehas lang sila.

Hindi pala. hehe

Need po ba ng official reciept everytime may sale ka what if ayaw ng costumer ng resibo at umalis agad kailangan mo,pa ren isulat.

Yes po. Sa batas po, Kailangan niyo po mag issue ng Official Receipt everytime na may sale kayo.

What is the difference between a provisional receipts and an official receipt

Kung mag claim po kayo ng expense, kailangan niyo po mag request ng Official Receipt aside sa Provisional Receipt. Supplementary Receipt lang po kasi yung Provisional Reciepts.

Sa Sales Invoice, pwede po ba mag input ng amount in US dollar for a certain product/services rendered then sometimes Philippine Peso naman? if yes, same lang po ba ng % ilalagay for tax column/item. Thank you!

Pwede naman po dollars ang ilagay niyo sa Sales Invoice. Lagyan niyo lang ng Exchange Rate sa Araw na yun. Para hindi po kayo mahirapan magconvert sa Peso kapag ilalagay niyo na sa Books of Accounts niyo. Same pa din po yung tax rate lalo na kapag non-VAT kayo.

Sir/Mam paano naman po kung enterprise. Ang nature ng bus. ay trucking bibili ng aggregates tapos ibebenta yung goods plus services. Tapos naka terms ang payment ng 60 to 90days. Ano po ba ang dapat na gamitin na resibo?

1. Kapag Goods plus Service, kadalasan Official Receipts ginagamit dyan. 2. Kapag naman po 90 days ang terms, Kailangan niyo po mag issue ng Billing Statement sa Date of Sales, then issue Collection Receipt sa date of Collection. 3. Para sigurado po, i-confirm niyo din po sa BIR yan.

Good day. I was issues a sales invoice by a surplus car shop. Informations written are

Name of buyer

Date purchased

Product

Amounting P16,000.

Breakdown of

Vatable sale of P15357.14

Zero related sales of P642.86

No signature by seller and customer. How do i know if its not fraudulent receipt?

Hi Ren,

Usually, It’s not a valid receipt if you can’t see the:

1. TIN number of the seller and the

2. BIR Authority to Print Number (ATP)

Thank you sir jude feliciano. There is a tin no. And i can see that there is also an atp. So this may be a valid invoice.

Regarding over pricing? Where do i make a complaint? Thank you if you can just help.

Regarding question or correction of receipt and price.

You can talk to the staff that issue you the receipt first.

If it’s not resolved, go to the manager or the owner.

sir kailan ginagamit ang sales invoice at official receipt?

Use Sales Invoice kapag nagbebenta ka ng goods tulad ng hardwares at take out food.

Use Official Receipt kapag nagbebenta ka ng service, nag paparent ka, or nag offer ka ng dining experience.

Is charge sales invoice valid for claiming input tax even not securing a collection receipt from the seller ?

Yes. Charge Sales Invoice is the basis of claiming of input tax.

Hi is it mandatory to include the customer’s tin number in sales invoice if he/she provided one?

Hello Alyanna.

Mandatory po na include ang customer’s TIN sa Sales Invoice

Lalo na kapag Corporation ang customer or Malaki ang amount.

Good day! I have a question. Is it possible to have both OR and Sales Invoice when you are engaged in selling both services and goods? Thanks in advance.

Hi Michaela,

Yes po, It’s Possible to have both OR and Sales Invoice

🙂

Hello,

Sir hnd po kaya mag double taxation yun? since you have two documents to issue?

Depende po yan sa document na iissue niyo.

Pero kung tinutukoy niyo po ay documents ng Sales Invoice at Official Receipt.

Pipili lang kayo ng isa na iissue sa customer to avoid double taxation.

Sir asked ko lang po pwede pa po ba mag paSale invioce ung customer kahit nkalipas na po more than 2 months ang kanyang resibo. Need ko lang po sagot nyo

Hi Ella,

Dapat ay binibigyan po natin ng resibo si customer kahit hindi siya humingi.

Para may proof po siya na bumili siya sa inyo.

If hindi niyo po siya na issuehan ng Sales Invoice last 2 months.

Ang pwede niyo po gawin ay ilagay niyo na lang ang current date kung kailan siya humingi ng resibo.

Para happy si customer at hindi na din po kayo mag update ng tax return niyo.

Kapag happy si customer, may chance na bumili po siya ulit sa inyo.