The De Minimis Benefits are benefits of relatively small value given by the employer to his or her employees to improve health, goodwill, contentment, or efficiency of his/her employees.

These are not subject to Income Tax as well as withholding tax on compensation of both managerial and rank and file employees.

After reading this guide, you will learn:

1. What are the Advantages of using De Minimis Benefits?

2. What are the Tax Exempt De Minimis Benefits under TRAIN Law?

3. How much De Minimis Benefits can the Employer claim as Salary Expense every year?

1. What are the Advantages of using De Minimis Benefits?

a. The Employees will be happy because they will receive Tax Exempt Compensation

b. The Employers can claim the De Minimis benefits as Salary Expense of their company.

2. What are the Tax Exempt De Minimis Benefits under TRAIN Law?

The following shall be considered as “De Minimis” Benefits:

1. Monetized unused vacation leave credits of private employees not exceeding ten (10) days during the year.

2. Monetized value of vacation and sick leave credits paid to government officials and employees.

3. Medical Cash Allowance to dependents of employees, not exceeding P1,500 per employee per semester or P250 per month.

4. Rice Subsidy of P2,000 or one sack of 50kg. rice per month.

5. Uniform and Clothing Allowance not exceeding P6,000 per annum.

6. Actual Medical Assistance, e.g. medical allowance to cover medical and healthcare needs, annual medical/executive check-up, maternity assistance, and routine consultations, not exceeding P10,000 per annum.

7. Laundry Allowance not exceeding P300 per month.

8. Employees Achievement Awards, e.g. for length of service or safety achievement, which must be in the form of a tangible personal property other than cash or gift certificate, with annual monetary value not exceeding P10,000 received by the employee under established written plan which does not discriminate in favor of highly paid employees.

9. Gifts given during Christmas and Major Anniversary Celebration not exceeding P5,000 per employee per annum.

10. Daily Meal Allowance for Overtime work and night/graveyard shift not exceeding twenty-five (25%) of the basic minimum wage on per region basis

All other benefits given by employers which are not included in the above enumeration shall not be considered as “de minimis” benefits,

Hence, shall be subject to income tax as well as withholding tax on compensation income.

3. How much De Minimis Benefits can the Employer claim as Salary Expense every year?

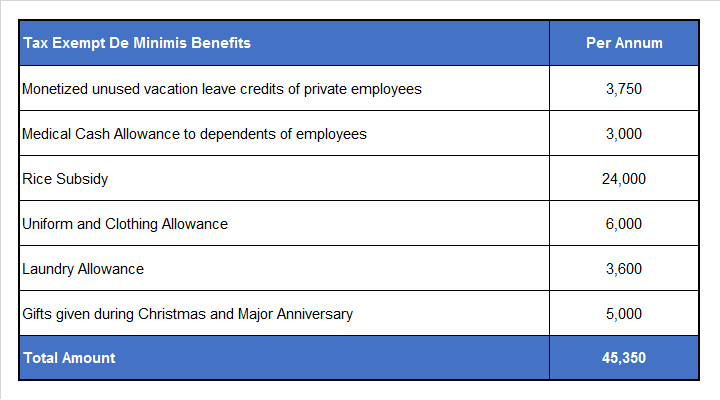

Below is a sample of computation of:

a. How much each employee can received as his/her Tax Exempt De Minimis Benefits.

b. And how much the employer can claim as a Salary Expense.

This sample computation is for informational use only. Amount will change based on the situation of every businesses and employees.

References:

a. Republic Act 10963 (TRAIN Law)

b. Amendments Introduced by TRAIN Law Relative to Withholding of Income Tax (RR 11-2018)

c. Further Amendments to Revenue Regulation RR 5-2008, RR 3-1998, RR 2-1998 (RR 5-2011)

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can Contact us here.