This article is all about Documentary Stamp Tax under TRAIN Law that took effect on January 1, 2018.

You should read this if you Buy, Lease and Sell Real Property, You issue Stocks, you issue Power of Attorney, and/or you issue Leases and Other Hiring Agreement.

After reading this article, you will learn,

1. What is Documentary Stamp Tax?

2. Who Shall File Documentary Stamp Tax?

3. When and Where to File and Pay Documentary Stamp Tax?

4. What are the BIR Forms you need to file in Documentary Stamp Tax?

5. What are the Penalties in case of non-filing of Documentary Stamp Tax?

6. What are the attachments in Documentary Stamp Tax?

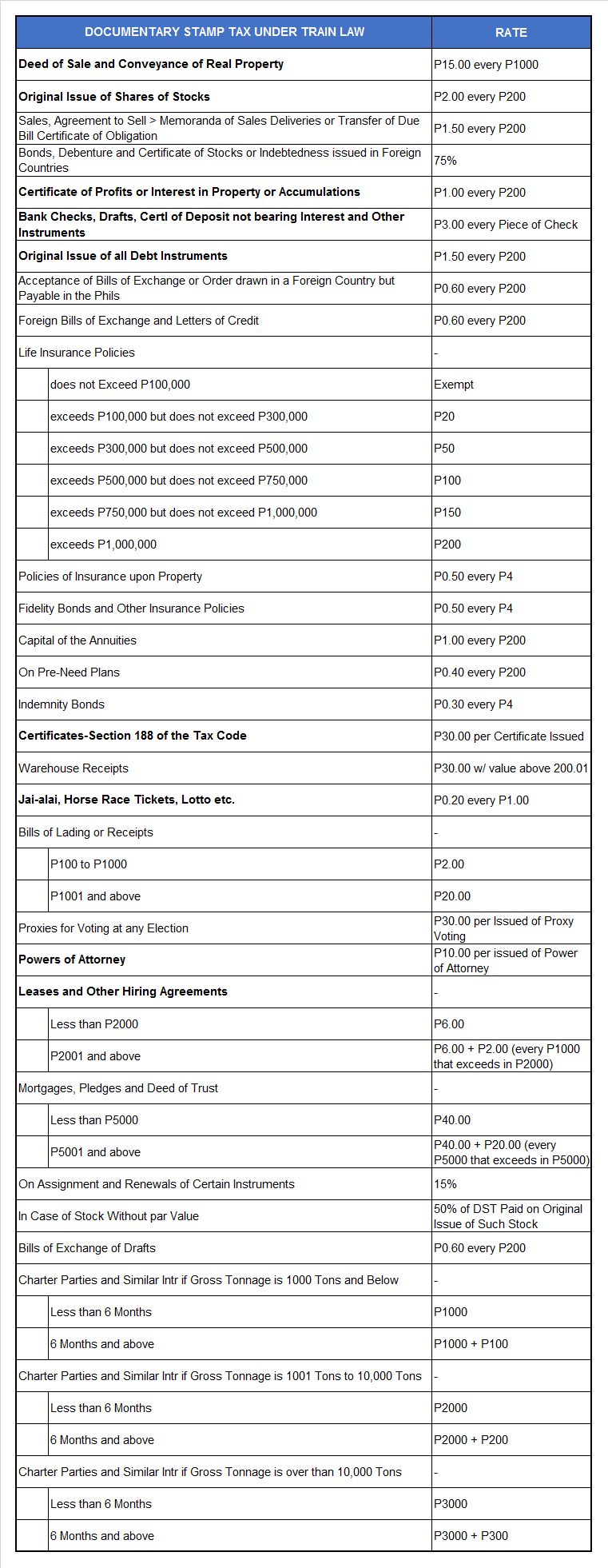

7. What are the Income Payments and Tax Rate subject to Documentary Stamp Tax?

What is Documentary Stamp Tax?

Documentary Stamp Tax are taxes imposed on documents.

These documents are, but not limited to Deed of Sale, Original Issuance of Stocks, Bank Checks, Debt Instrument, Birth Certificate, DTI Business Name Certificate, Lotto, Power of Attorney, Leases and Other Hiring Agreements.

Who Shall File Documentary Stamp Tax?

The Documentary Stamp Tax shall be filed in triplicate by:

a. The following person making, signing, issuing, accepting or transferring the document or facility evidencing transaction

b. By a metering machine user who imprints the documentary stamp tax due on the taxable document; and

c. By a revenue collection agent for remittance of sold loose documentary stamps.

When and Where to File and Pay Documentary Stamp Tax?

The return shall be filed and the tax paid within five (5) days after the close of the month when the taxable document was made, signed, issued, accepted or transferred.

The return shall be filed with and the tax paid to the Authorized Agent Bank (AAB) within the territorial jurisdiction of Revenue District Office (RDO) where the seller/transferor is required to be registered or where the property is located in case of sale of real property.

What are the BIR Forms you need to file in Documentary Stamp Tax?

a. Documentary Stamp Tax Declaration/Return (BIR Form No. 2000)

b. Documentary Stamp Tax Declaration/Return (BIR Form No. 2000-OT) for one-time transaction.

There are instances where the BIR allows you to buy Loose Documentary Stamp Tax in their office so that you will not need to file BIR Forms anymore.

Example of this is the stamp you attached in BIR Certificate of Registration.

What are the Penalties in case of non-filing of Documentary Stamp Tax?

a. 25%-50% surcharge based on tax unpaid

b. 12% annual interest based on tax unpaid

c. Compromise Penalty of P1,000 to 50,000

What are the attachments in Documentary Stamp Tax?

a. Photocopy of the document to which the documentary stamp shall be affixed;

b. Proof of payment of documentary stamp tax paid upon the original issue of the stock, if applicable.

c. For metering machine user, a schedule of the details of usage or consumption of documentary stamps

What are the Income Payments and Tax Rate subject to Documentary Stamp Tax?

References:

a. Republic Act 10963 (Train Law)

b. Rules and Regulation Implementing the Documentary Stamp Tax Rate Adjustment under TRAIN Law (RR 4-2018)

What’s Next?

d. If you have questions and comments regarding tax, accounting, and business registrations, you can Contact us here.