Maraming professionals, franchisees, at contractors ang naguguluhan dito: “Anong mas okay — 8% or graduated tax?” Let’s make it simple. Imagine this: Isa kang dentist earning below ₱3 million … [Read more...] about 8% or Graduated Tax? One saves time, the other saves money

Resources

How to Register Your Business Name in DTI?

This guide is for aspiring business owner and/or entrepreneur who want to make his/her business legit. The first step in Business Registration of a sole proprietorship is to go to DTI Regional/ … [Read more...] about How to Register Your Business Name in DTI?

How to Register Barangay Micro Business Enterprises (BMBE)

This article is for business owners and people who want to learn about Barangay Micro Business Enterprises (BMBE). After reading this free guide, your will learn about: 1. What are the Benefits of … [Read more...] about How to Register Barangay Micro Business Enterprises (BMBE)

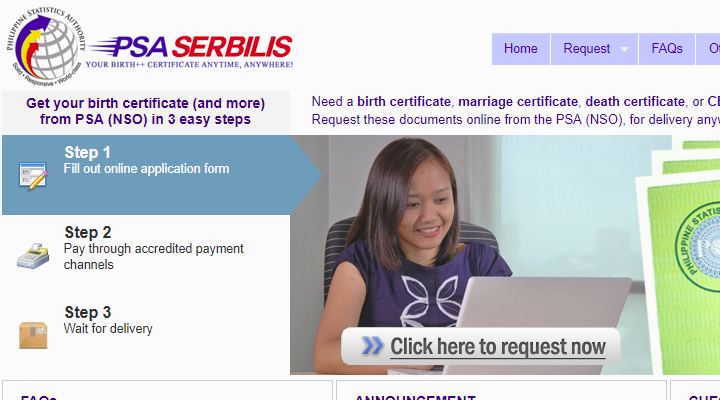

How to Get an PSA Birth Certificate Online?

This article will guide you on how to get Philippine Statistics Authority (PSA) Birth Certificate Online. When you choose for this method, The PSA Delivery Service allows you to enjoy … [Read more...] about How to Get an PSA Birth Certificate Online?

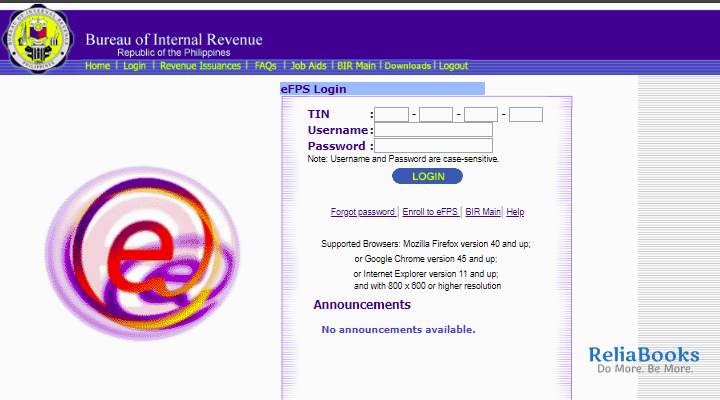

Who are Mandated to File and Pay through eFPS?

eFPS is different from eBIRForm. eBIRForm is an application or software you download in the website of the BIR, www.bir.gov.ph. Filing of taxes happen in the BIR application. In eFPS, you … [Read more...] about Who are Mandated to File and Pay through eFPS?

Submission of Inventory List

According to Section 13 of Revenue Regulations No. V-1, otherwise known as the Bookkeeping Regulations, Persons required by the laws to pay internal revenue taxes on business shall keep, in … [Read more...] about Submission of Inventory List

Ease of Doing Business Act of 2018

The Ease of Doing Business and Efficient Government Service Delivery Act of 2018 or Republic Act No. 11032 applies to all government offices and agencies. This includes local government units … [Read more...] about Ease of Doing Business Act of 2018

Permit to Use Loose-Leaf Books of Accounts

This article is all about Loose-Leaf Books of Accounts. You should read this if you’re looking for an alternative in writing in your manual books of account. After reading this article, you … [Read more...] about Permit to Use Loose-Leaf Books of Accounts

Documentary Stamp Tax under TRAIN Law

This article is all about Documentary Stamp Tax under TRAIN Law that took effect on January 1, 2018. You should read this if you Buy, Lease and Sell Real Property, You issue Stocks, you issue Power … [Read more...] about Documentary Stamp Tax under TRAIN Law

Fringe Benefits Tax under TRAIN Law

This article is all about Fringe Benefit Tax under TRAIN Law that took effect on January 1, 2018. You should read this if you are the owner or the accountant of a company that gives benefits to … [Read more...] about Fringe Benefits Tax under TRAIN Law

Final Withholding Tax under TRAIN Law

This article is all about Final Withholding Tax under TRAIN Law that took effect on January 1, 2018. You should read this if you are the owner or accountant of a corporation, partnership and/or you … [Read more...] about Final Withholding Tax under TRAIN Law

10 Tax Exempt De Minimis Benefits under TRAIN Law

The De Minimis Benefits are benefits of relatively small value given by the employer to his or her employees to improve health, goodwill, contentment, or efficiency of his/her employees. These are … [Read more...] about 10 Tax Exempt De Minimis Benefits under TRAIN Law

How to Compute Income Tax Withheld on Compensation under TRAIN Law?

This guide is for business owners, professional, accountants, bookkeepers, students who want to learn how to learn how to compute Income Tax Withheld on Compensation under TRAIN Law. After reading … [Read more...] about How to Compute Income Tax Withheld on Compensation under TRAIN Law?

Withholding Tax on Compensation under TRAIN Law

Every business owner who have employees are required to deduct and withhold the tax from their employees. The employer is required to file taxes even if there is zero tax withheld. But not all … [Read more...] about Withholding Tax on Compensation under TRAIN Law

How do You Register your Employees to the BIR?

All employers shall require their concerned employees to accomplish in triplicate the: 1. Application for Registration BIR Form 1902, if the employee does not have existing TIN … [Read more...] about How do You Register your Employees to the BIR?

What are the Allowable Deductions in the Gross Estate under TRAIN Law?

This is a follow up article of my blog post “Estate Tax in the Philippines under Train Law”. You should read this if want to know what are the Allowable Deductions in the Gross Estate of … [Read more...] about What are the Allowable Deductions in the Gross Estate under TRAIN Law?

Estate Tax in the Philippines under Train Law

Death is inevitable. And so are taxes. Did you know? When someone dies in your family. All his or her properties will be transferred to the rightful beneficiary or his or her heirs. But … [Read more...] about Estate Tax in the Philippines under Train Law

Donor’s Tax in the Philippines under TRAIN Law

This guide is for the people who wants to know the updates in Donor’s Tax in the Philippines under TRAIN Law. You should read this if you can see yourself donating properties in the … [Read more...] about Donor’s Tax in the Philippines under TRAIN Law

Withholding Tax on Professional Fees under TRAIN Law

Did you know that payments to Professionals are subject to Expanded Withholding Tax? That means, if you pay services of self-employed professionals, you need to withhold tax from them. Failure … [Read more...] about Withholding Tax on Professional Fees under TRAIN Law

Expanded Withholding Tax under TRAIN LAW

As a business owner, you might be required to file Expanded Withholding Tax. But not all taxpayer are aware if they need to file Expanded Withholding Tax. As a result they get penalized for not … [Read more...] about Expanded Withholding Tax under TRAIN LAW