This article is all about Final Withholding Tax under TRAIN Law that took effect on January 1, 2018.

You should read this if you are the owner or accountant of a corporation, partnership and/or you transact to the government.

In this article, you’ll learn about:

1. What is Final Withholding Tax?

2. Who are required to File and Pay Final Withholding Tax?

3. What will happen if the Withholding Agent fails to Withhold Final Taxes?

4. What and When to File and Pay Final Withholding Tax?

5. What are the Income Payments and Tax Rate subject to Final Withholding Tax?

6. Where to File and Pay Final Withholding Tax?

7. What are the Attachments required in filing BIR Form No. 1604CF?

8. What is the Quarterly Alphalist of Payees (QAP)?

9. What is the Certificate of Final Tax Withheld at Source (BIR Form No. 2306)

1. What is Final Withholding Tax?

Final Tax is a kind of withholding tax which is prescribed on certain income payments.

It is not creditable against the Income Tax due of the Payee or Receiver of the Income.

Once an income is subjected to Final Tax, it will not be furthered taxed under the Income Tax and/or capital gains tax.

2. Who are required to File and Pay Final Withholding Tax?

Not everyone is a withholding agent.

You will be a Withholding Agent only if your payment is included in the list of Income Payments subject to Final Withholding Tax.

This includes but not limited to Dividends, Distributive Share in Taxable Partnership, Royalties, and Prizes.

3. What will happen if the Withholding Agent fails to Withhold Taxes?

If the withholding agent fails to withhold Final Withholding Tax, he/she will need to pay penalties amounting to:

a. 25%-50% surcharge based on tax unpaid

b. 12% annual interest based on tax unpaid

c. Compromise Penalty P1,000 – 25,000 every time you fail to withhold

4. What and When to File and Pay Final Withholding Tax?

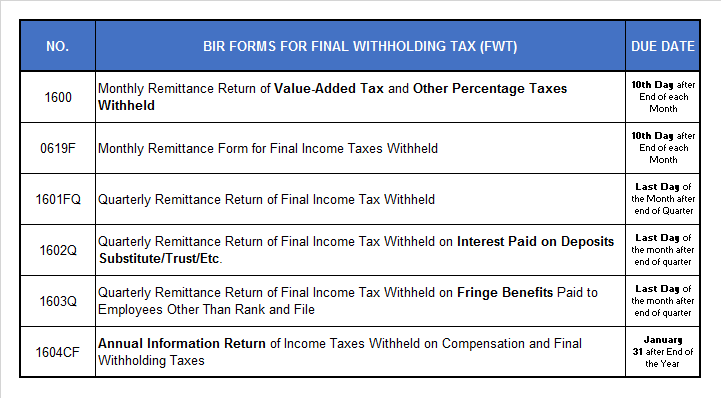

Commonly use BIR Form here are the 0619F, 1601FQ, and 1604CF.

BIR Form No. 1600 is usually use by the Government to Withhold Final Withholding VAT to their supplier.

BIR Form No. 1602Q is usually use by the Banks.

BIR Form 1603Q is use by Companies who give Fringe Benefits to its Employees other than Rank and File.

5. What are the Income Payments and Tax Rate subject to Final Withholding Tax?

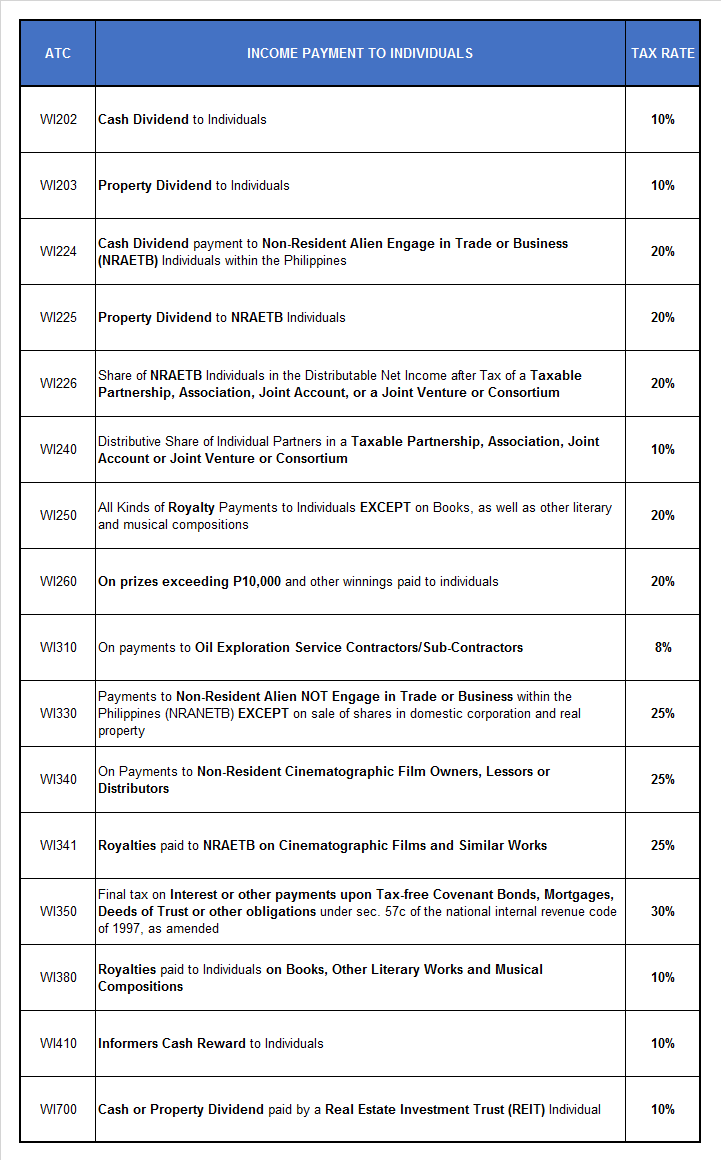

a. Below are the Income Payments to Individuals that are Subject to Final Withholding Tax (FWT).

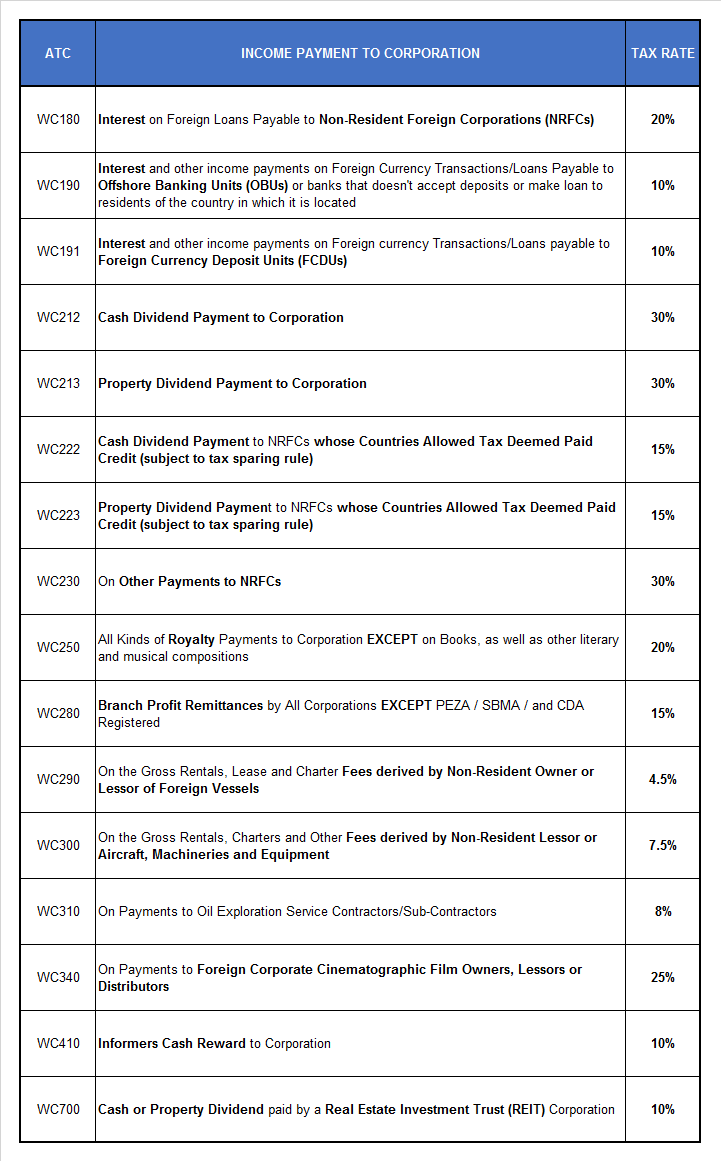

b. Below are the Income Payments to Corporation that are Subject to Final Withholding Tax.

c. Below are the Income Payments on Interest Paid to Bank Deposits, Amount withdrawn on Decedent’s Deposit Account, etc.

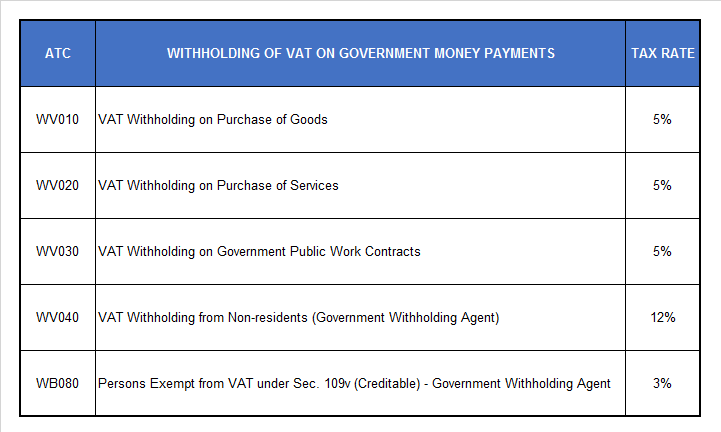

d. Below are the Income Payments from the Government that are Subject to Withholding of 5% to 12% VAT and 3% Percentage Tax.

6. Where to File and Pay Final Withholding Tax?

The return shall be filed and the tax paid/remitted with the Authorized Agent Bank (AAB) of the Revenue District Office (RDO) having jurisdiction over the withholding agent’s place of business/office.

A taxpayer may file a separate return for the head office and for each branch or place of business/office or a consolidated return for the head office and all the branches/offices.

In the case of large taxpayers only one consolidated return is required.

7. What are the Attachments required in filing BIR Form No. 1604CF?

a. Alphalist of Employees as of December 31 with No Previous Employer within the Year. (Schedule 7.3)

b. Alphalist of Employees as of December 31 with Previous Employer/s within the Year. (Schedule 7.4)

c. Alphalist of Employees Terminated before December 31. (Schedule 7.1)

d. Alphalist of Employees whose Compensation Income Are Exempt from Withholding Tax but Subject to Income Tax.

e. Alphalist of Employees other than Rank & File Who Were Given Fringe Benefits During the year. (Schedule 6)

f. Alphalist of Payees Subjected to Final Withholding Tax. (Schedule 5)

g. Alphalist of Minimum Wage Earners. (Schedule 7.5)

The attachment above are alphabetical list of all taxpayers where you withhold taxes from.

You file this together with BIR Form No. 1604CF on or before Jan. 31 after the end of the taxable year.

The employer inputs his/her employees in the BIR Alphalist Data Entry and validated using BIR Alphalist Validation.

You can download this to the BIR website, www.bir.gov.ph.

After Validation, the employer need to email it to esubmission@bir.gov.ph.

After that, you will received email confirmation from the BIR that the report you submit is correct.

Print the email confirmation and attached it to BIR Form 1604CF

And Submit 2-3 Copies to the BIR.

8. What is the Quarterly Alphalist of Payees (QAP)?

This is an alphabetical list of all taxpayers where you withhold taxes from.

You file this together with BIR Form No. 1601FQ on or before the last day of the month after the end of quarter.

You file this using BIR Alphalist Data Entry and BIR Validation Module which you can download in the website of BIR, www.bir.gov.ph.

After Data Entry and Validation of QAP, you need to email it to esubmission@bir.gov.ph.

After that, you will received email confirmation from the BIR that the report you submit is correct.

Print the email confirmation and attached it to the BIR Quarterly Remittance Return of Final Income Tax Withheld as proof that you filed on time.

9. What is the Certificate of Final Tax Withheld at Source (BIR Form No. 2306)

This return is a proof that the Payor Withhold Final Tax from the Payee.

The Payor give this to the Payee either every 20th day following the close of the taxable quarter or upon request of the payee.

Once an income is subjected to Final Tax, it will not be furthered taxed under the Income Tax and/or capital gains tax.

If the government is the one who withholds tax from you. You can use the BIR Form No. 2306 as a tax deduction in filing your Percentage or VAT return.

References:

a. Republic Act 10963 (Train Law)

b. Amendments Introduced by TRAIN Law Relative to Withholding of Income Tax (RR 11-2018)

c. Implementing Republic Act No. 8424 (RR 2-1998)

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can Contact us here.