This article is all about Fringe Benefit Tax under TRAIN Law that took effect on January 1, 2018.

You should read this if you are the owner or the accountant of a company that gives benefits to managerial and supervisory employees.

After reading this article, you will learn,

1. What are Fringe Benefits?

2. What are the Benefits that are subject to Fringe Benefits Tax?

3. What are the Fringe Benefits that are NOT Subject to the Tax?

4. What are the Tax Rate of Fringe Benefits Tax?

5. How to Compute the Fringe Benefits Tax?

6. What and When to File and Pay Fringe Benefits Tax?

1. What are Fringe Benefits?

Fringe benefits are goods, services or other benefits granted in cash or in kind by an employer to an individual employee that do not belong to rank and file employees.

2. What are the Benefits that are subject to Fringe Benefits Tax?

This includes, but not limited to, the following:

a. Housing

b. Expense Account

c. Vehicle of any kind

d. Household Personnel, such as maid, driver and others

e. Interest on loan at less than market rate to the extent of the difference between the market rate and actual rate granted

f. Membership fees, dues and other expenses borne by the employer for the employee in social and athletic clubs or other similar organizations

g. Expenses for foreign travel

h. Holiday and Vacation Expenses

i. Educational Assistance to the employee or his dependents; and

j. Life or health insurance and other non-life insurance premiums or similar amounts in excess of what the law allows.

3. What are the Fringe Benefits that are NOT Subject to the Tax?

The following that are not subject to Fringe Benefit Tax are:

a. Benefits given to employees that are required by the nature of or necessary to the trade, business or profession of the employer,

b. Benefits given to employees that is for the convenience and advantage of the employer.

c. Statutory Minimum Wage for Minimum Wage Earners (MWEs)

d. Holiday Pay, Overtime Pay, Night Shift Differential for MWEs only

e. 13th Month Pay and Other Benefits

f. De Minimis Benefits Given to Managerial and Rank and File Employees

g. SSS, PhilHealth, and Pag-IBIG Mandatory Contributions

h. Other Non-Taxable Compensation

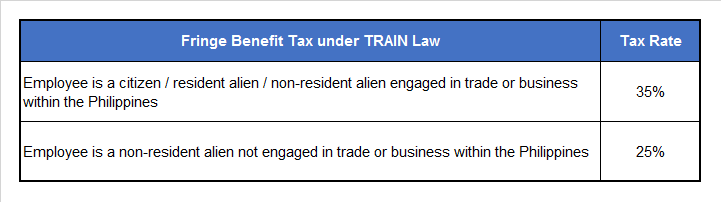

4. What are the Tax Rate of Fringe Benefits Tax?

5. How to Compute the Fringe Benefits Tax?

a. First, determine the Grossed-Up Value of the fringe benefit by dividing the actual monetary value by 65%.

b. Then, Multiply the Grossed-up value by 35% to get the Fringe Benefit Tax (FBT).

If the employee is a non-resident alien not engaged in trade or business in the Philippines, get the Grossed-Up Value by dividing the actual monetary value by 75% and multiply it to 25% to get the Fringe Benefit Tax.

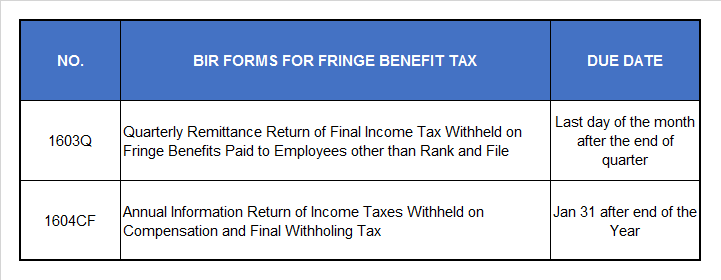

6. What and When to File and Pay Fringe Benefits Tax?

References:

a. Republic Act 10963 (Train Law)

b. Amendments Introduced by TRAIN Law Relative to Withholding of Income Tax (RR 11-2018)

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can Contact us here.