This article will give you an overview about the important dates to remember for Philippine businesses when it comes to SEC, LGU, and BIR.

Have you ever tried running for a race? It can be 5k, 10k, 21k, 42k, etc. If yes, I think you will agree with me that it will help you if you know the exact date of the race. Because if you know the date, you will have time to prepare. You can also be sure that you will not miss your race. This is also the same when you start your own business. Except that business have penalties.

When you know the important dates for Philippine businesses, you will have the time to prepare. You will save money for rush processing and unnecessary penalties.

The purpose of this article is not to discourage next generation entrepreneurs but to help you to be aware of what you need to comply in order to avoid penalties.

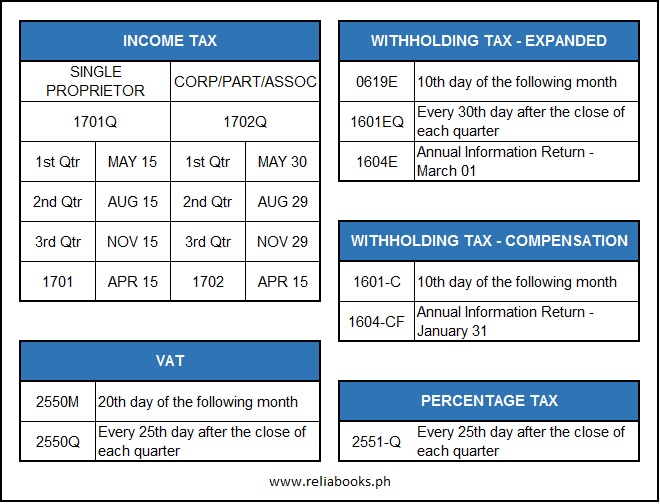

In the 1st summary, you will see what are the tax return/s you or your accountant need to file when you register your business. You will need to file this with or without operation to avoid penalties. You can also see this in your BIR Certificate of Registration (BIR Form 2303).

For Income Tax, you’re required to file 1701Q and 1701 if you’re a single proprietor. If you’ve a corporation, partnership, or association, you need to file 1702Q and 1702.

When it comes to VAT and Percentage Tax, you required to file VAT if your annual gross sales or receipts exceed P1,919,500. If it didn’t exceed the threshold, Percentage tax is the one (1) you’re required to file.

You’re required to file withholding tax – expanded if you’re paying goods or services like professional fees, rental, contractors, and commission. If you have employees, you need to file withholding tax – compensation.

If you have tax due, you need to pay it in authorized agent banks (AAB) in the same RDO where your business is located. Again, don’t forget to file with or without operation to avoid penalties.

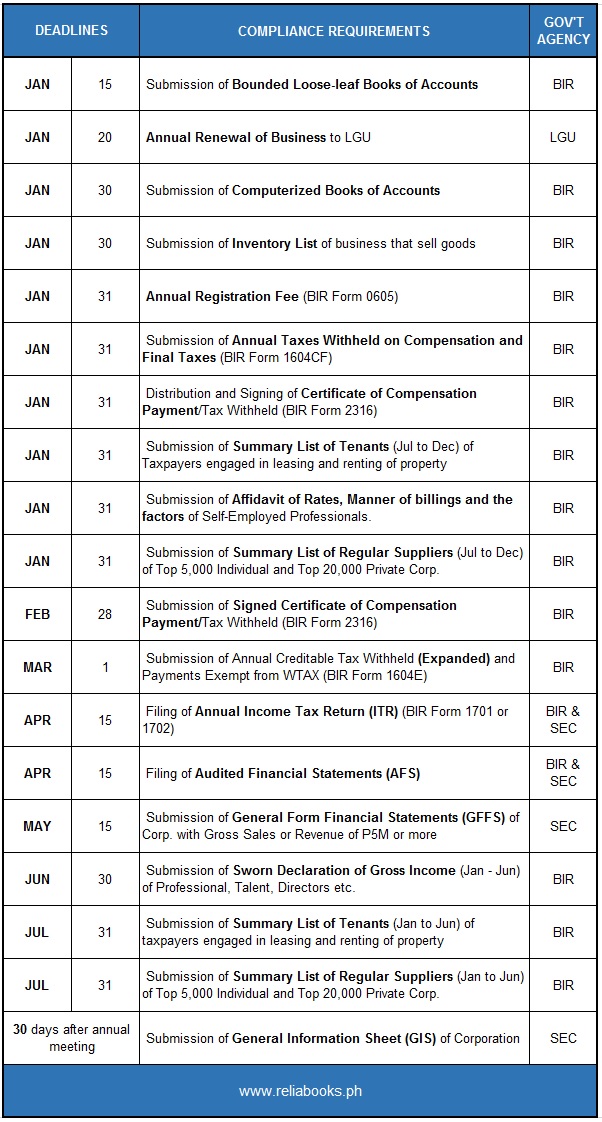

In the 2nd summary, you will see what you or your accountant need to submit after your business’ taxable year.

It also includes the the last day of when you need to submit it without penalties. If you don’t want your patience to be test, its better that you avoid the deadlines as much as possible when you submit your requirements.

In the summary above, I just focused on the important dates to remember for Philippine businesses. I also put few notes of whether you’re required to submit or not. I also highlighted the keywords you need to remember so that you will have an idea of what to ask.

To those who are using manual books of accounts, you are not required to renew and re-stamp your books to BIR annually. They are only renewed if your books are already exhausted or used.

If you’re not sure if whether you’re required to submit or not, it’s best if you ask your accountant to be sure. I hope this guide helps you avoid penalties in the future.

Updates:

According to RMC 122-2019, the Submission of the Semestral List of Regular Supplier (SRS) is Terminated.

This was received by the BIR on Nov. 22, 2019.

If you have questions or comments regarding tax, accounting, and business registrations, you can contact us here.

You can also visit and like our Facebook Page for important updates and upcoming live training.