What is Percentage Tax?

Percentage Tax is a business tax that is imposed on persons who sell or lease goods, properties or services in the course of their business.

Percentage Tax Under Train Law

Before, the filing and paying of Percentage tax is done monthly. Now, the filing and paying of Percentage Tax is done quarterly. (i.e April, July, October, and January)

Aside from that, the threshold of gross annual sales and/or receipt before the taxpayer become VAT is increased from P1,915,500 to P3,000,000.

In this article, you’ll learn about:

- Who Shall File Quarterly Percentage Tax?

- When and Where to File and Pay Quarterly Percentage Tax?

- What is the Basis of Quarterly Percentage Tax

- What are the Tax Rates involving Percentage Tax?

- What if the Filer Paid the Quarterly Percentage Tax using 2551M?

A. Who Shall File Quarterly Percentage Tax?

1. Person whose gross annual sales and/or receipts do not exceed P3,000,000 and who are not VAT- Registered Persons.

2. Domestic Carriers and Keepers of Garages.

3. International air and shipping carriers doing business in the Philippines.

4. Franchises of Gas and Water Utilities.

5. Franchises on radio/TV broadcasting companies whose annual gross receipts do not exceed P10M

6. Oversees dispatch, message or conversation originating from the Philippines except on services involving the following:

a. Government of the Philippines,

b. Embassy and Consular Offices,

c. International Organization with international agreement, and

d. News Services which messages deal exclusively with the collection or dissemination of news,

7. Proprietors, lessees or operators of cockpits, cabarets, night or day clubs, boxing exhibitions, professional basketball games, jai-alai and race tracks.

8. Life assurance companies.

9. Agents of foreign insurance companies.

10. Banks, non-bank financial intermediaries and finance companies.

B. When and Where to File and Pay Quarterly Percentage Tax?

The taxpayer shall file and pay using BIR Form 2551Q within twenty-five (25) days after the end of each taxable quarter.

The return shall file through Electronic Bureau of Internal Revenue Forms (eBIRForms) or Electronic Filing and Payment System (eFPS).

And shall be paid through eFPS or Authorized Agent Bank (AAB) of the Revenue District Office (RDO) where the taxpayer is registered and conducting business.

The taxpayer may file a separate return for the head office and for each branches or a consolidated return for the head office and all the branches.

In the case of large taxpayers, only one consolidated return is required.

C. What is the Basis of Quarterly Percentage Tax?

Taxable amount in the quarterly percentage tax return shall be the total gross sales/receipts/premiums for the quarter.

“Gross Receipts” means all amount received by the prime or principal contractor, undiminished by any amount paid to any subcontractor under subcontract arrangement.

For the purpose of the amusement tax, the term “gross receipts” embraces all the receipts of the proprietor, lessee or operator of the amusement place. Said gross receipts also include income from television, radio and motion picture rights.

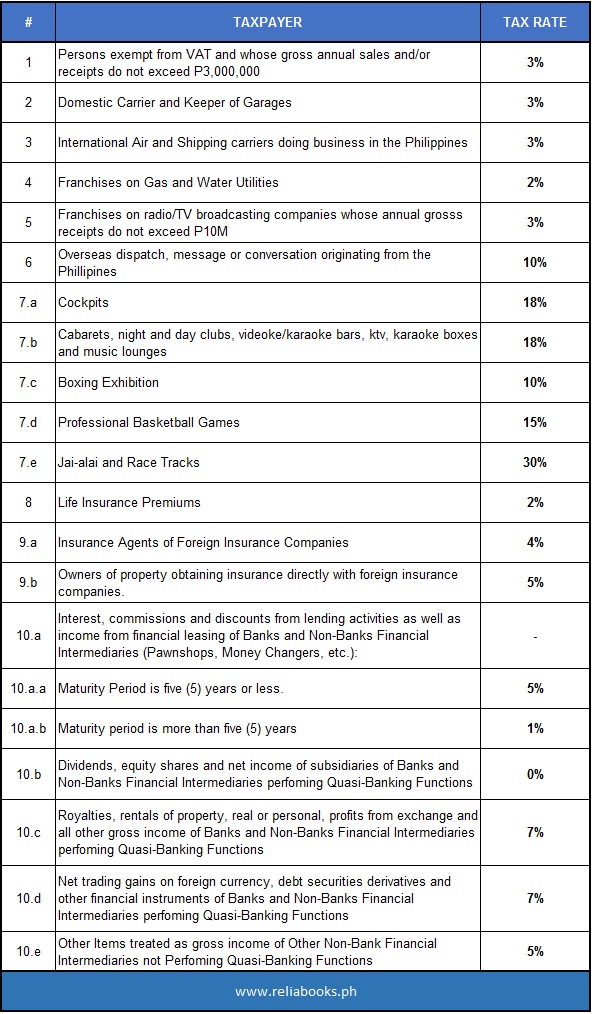

D. What are the Tax Rates involving Quarterly Percentage Tax?

E. What if the Filer Paid the Quarterly Percentage Tax using 2551M?

If this happens, the taxpayer still needs to file the quarterly percentage tax return (BIR Form No. 2551Q) even if he/she already filed 2551M.

Just indicate in the return the total gross sales/receipt for the quarter and the total payment made in the quarter.

For amended return, you’re required to attach the proof of payment and the previously filed tax return.

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can contact us here.