eFPS is different from eBIRForm.

eBIRForm is an application or software you download in the website of the BIR, www.bir.gov.ph.

Filing of taxes happen in the BIR application.

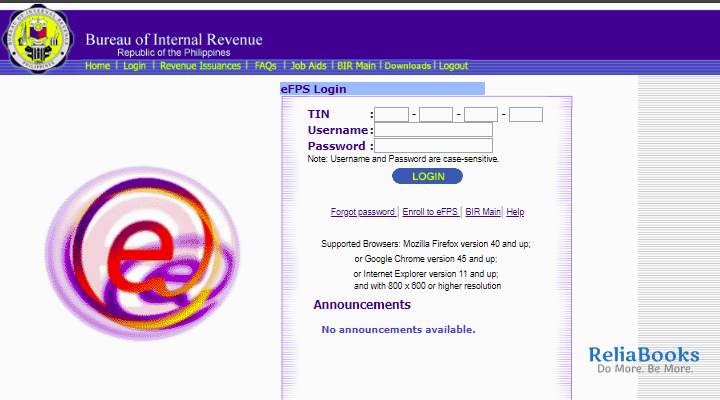

In eFPS, you just need to login in the website of the BIR.

Filing of taxes happen in the website of the BIR.

In this article, you will learn:

1. What is eFPS?

2. Who are mandated to File and Pay through EFPS?

3. How to Register EFPS in the BIR?

4. What are the penalties for failure to file returns under electronic systems of the BIR?

1. What is eFPS?

eFPS stands for Electronic Filing and Payment System.

It is the electronic processing and transmission of tax return information including attachments, and taxes due

to the government made over to the internet through the BIR website.

2. Who are mandated to File and Pay through EFPS?

A. Taxpayer Account Management Program (TAMP) Taxpayers (RR No. 10-2014)

B. Those required to secure the BIR Importer’s Clearance Certificate (BIR-ICC) and BIR Customs Broker Clearance Certificate (BIR BCC) (RR No. 10-2014)

C. National Government Agencies (RR No. 1-2013)

D. Licensed Local Contractors (RR No. 10-2012)

E. Enterprises enjoying Fiscal Incentives (PEZA, BOI, etc.) (RR No. 1-2010)

F. Top 5,000 Individual Taxpayers (RR No. 6-2009)

G. Corporations with Paid-up Capital Stock of P10 Million and above (RR No. 10-2007)

H. Corporations with complete Computerized Accounting System (RR No. 10-2007)

I. Procuring Government Agencies without VAT and Percentage Taxes (RR No. 3-2005)

J. Government Bidders (RR No. 3-2005)

K. Large Taxpayers (RR No. 2-2002, as amended)

L. Top 20,000 Private Corporations (RR No. 2-98, as amended)

M. Insurance Companies and Stockbrokers (RMC No. 71-2004)

3. How to Register EFPS in the BIR?

A. Go to BIR and tell them that you want to enroll in eFPS.

Bring your DTI, Mayor’s Business Permit, BIR Certification of Registration, and your current BIR Annual Registration (BIR Form No. 0605) for verification of information.

B. Ask the person in-charge if they have a format of Letter of Intent and the Email Address where you will submit the requirements.

C. Email to the email address given by the RDO a scanned receiving copy of:

a. Letter of Intent

b. Certificate authorizing up to three officers designated to file a return (For non-Individuals only)

D. For eFPS enrollment, Go to BIR website bir.gov.ph

a. Click on eServices, then EFPS icon

b. Click ENROLL to eFPS;

c. Complete Enrollment Forms then click SUBMIT

E. After successfully signed up, check your given email account and you will received a message “for investigation”

F. Go back to RDO to activate your enrollment.

G. Go to any Accredited Banks (e.g. Chinabank, UnionBank, UCPB, Security Bank, Landbank, etc.) where you intend to pay thru bank debit system.

4. What are the penalties for failure to file returns under electronic systems of the BIR?

All taxpayers, who are mandatory covered to file their returns using eFPS but fail to do so:

A. Shall be imposed a penalty of P1,000 – P50,000 per return

B. In addition, the taxpayer, shall also be imposed 25% surcharge and 12% interest per annum of the tax due to be paid.

C. Aside from that, RDOs are directed to include non-compliant taxpayers in their priority audit program.

This is because of filing a return not in accordance with existing regulations, thus, tantamount to WRONG VENUE filing

References:

A. Revenue Memorandum Circular No. 19-2015

B. Revenue Regulation No. 9-2001

C. Revenue Regulation No. 2-2002

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can Contact us here.