Did you know that payments to Professionals are subject to Expanded Withholding Tax?

That means, if you pay services of self-employed professionals, you need to withhold tax from them.

Failure to withhold will cost you surcharge, interest, and compromise penalties from BIR.

In this article, you’ll learn about

A. Who are the Professionals subject to Expanded Withholding Tax?

B. What is the Expanded Withholding Tax Rate for Professionals?

C. What rate shall apply in case there are two (2) EWT rates prescribed?

D. What are the requirements in order to be subjected to lower Withholding Tax Rate?

E. What are the responsibilities of hospitals, clinics and HMOs?

A. Who are the Professionals subject to Expanded Withholding Tax?

1. Licensed Individuals engaged in the practice of profession or calling

2. Professional entertainers, such as but not limited to, actors and actresses, singers, lyricists, composers and emcees

3. Professional Athletes

4. All directors and producers involved in movies, stage, radio, television and musical productions

5. Insurance agents and Insurance Adjusters

6. Management and Technical Consultants

7. Bookkeeping Agents and Agencies

8. Other recipients of talent fees

9. Fees of directors who are not employees of the company

10. Brokers and agents

11. Independent Sales Representatives and Marketing Agents of Companies

The amount subject to withholding tax shall not only include fees but also allowances and other form of income payments not subject to withholding tax on compensation.

In case of professional entertainers, professional athletes, and other recipient of talent fees, the amount subject to withholding tax shall include amounts paid to them in consideration for the use of their names or pictures in print, broadcast, or other media or for public appearances, for purposes of advertisements or sales proportion.

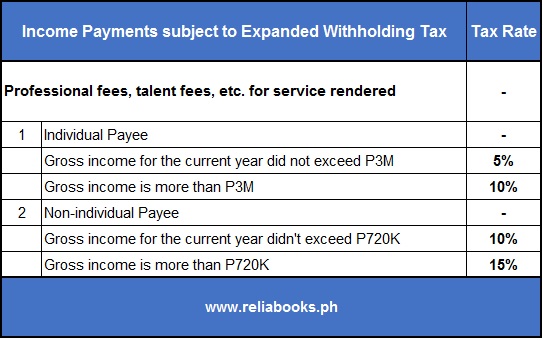

B. What are the Expanded Withholding Tax (EWT) Rates for Professionals?

C. What rate shall apply in case there are two (2) EWT rates prescribed?

In case there are two (2) rates prescribed, the higher rate shall apply if:

- The payee failed to provide the income payor/withholding agent of the required declaration

- The annual gross receipt/sales payment to individual exceeds P3,000,000

- The annual gross receipt/sales payment to non-individual exceeds P720,000

D. What are the requirements in order to be subjected to lower Withholding Tax Rate?

In order to be subjected to lower Withholding rate, the payee must submit copy to his/her withholding agent/s a copy BIR Certificate of Registration not later than January 15 of each year or at least prior to the initial payment of professional fees together with:

- Annex B-1 of RR 11-2018 for self-employed professionals with several payors

- Annex B-2 of RR 11-2018 for self-employed professionals with lone payor

- Annex B-3 of RR 11-2018 for Non-individual Taxpayer with several payor

The withholding agents/payors shall subsequently execute a sworn declaration Annex C of RR 11-2018 stating the number of payees who have submitted the Annexes “B-1”, “B-2”, “B-3” with the accompanying copies of their COR.

Annex C and list of payees shall be submitted to the concerned BIR Office on or before January 31 of each year or fifteen (15) days following the month when a new income recipient has submitted the payee’s sworn declaration.

E. What are the responsibilities of hospitals, clinics and HMOs?

For professional fees paid to medical practitioners by hospitals, clinics, HMOs and similar establishments:

- It shall be the duty and responsibility of the hospitals, clinics and HMOs to withhold and remit taxes due on the professional fees of their medical practitioners, paid by patient who were admitted to such hospital and clinics.

The hospitals and clinics shall not allow their medical practitioners to receive payment of professional fees directly from patients.

The hospitals and clinics must include the professional fees in the total medical bill of the patient which shall be payable directly to the hospital or clinic.

2. The withholding tax shall not apply whenever there is proof that no professional fee has in fact been charged by the medical practitioner and paid by his patient.

There must be a sworn declaration jointly executed by the medical practitioner and the patient or his duly authorized Representative.

The sworn declaration or the form presented in Annex A of RR 11-2018 shall constitute as part of the records and shall be made readily available to any duly authorized Revenue Officer for tax audit purposes.

The administrator of the hospital or clinic shall inform the concerned LTS/RR/RDO about any medical practitioner who fails or refuses to execute the sworn declaration, within 10 days from the occurrence of such events.

3. Hospitals, clinics, HMOs shall submit the list containing the names and address of medical practitioners every 15th day after the end of each calendar quarter, to the concerned Revenue Region for non-large taxpayers and National Office or Large Taxpayer District Office for large taxpayers, where such hospital or clinic is registered in the prescribed format.

a. Medical Practitioners whose professional fee was paid by the patients directly to the hospital or clinic.

b. Medical Practitioner who did not charge any professional fee from their patients.

4. Medical Practitioners shall include medical technologist, occupational therapists, physical therapists, speech therapists, nurses, and other medical practitioners who are not under employer-employee relationship with hospital, clinics and HMOs

5. Hospitals, Clinics and HMOs shall be responsible for the accurate computation of taxes to be withheld on professional fees paid by the patients to the hospital, clinic and HMOs.

The List of all income of Medical Practitioner shall be included in the Alphalist of Payees Subject to Expanded Withholding Tax and shall attached to BIR Form No. 1604-E.

Likewise, the hospitals, clinics, or HMOs shall issue a Certificate of Creditable Withholding Tax Withheld at Source (BIR Form No. 2307) to medical practitioners who are subject to withholding, every 20th day following the close of the taxable quarter or upon request of the payee.

References:

Amendments Introduced by TRAIN Law Relative to Withholding of Income Tax (RR 11-2018)

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can contact us here.