This guide is for the people who wants to know the updates in Donor’s Tax in the Philippines under TRAIN Law.

You should read this if you can see yourself donating properties in the future.

In this article, you will learn about:

1. What is the New Rate of Donor’s Tax?

2. Is Donation during Election Campaign subject to Donor’s Tax?

3. When is the Donation of an Immovable Property Valid?

4. When is the Valuation Date of the Donation Made?

5. How is Donor’s Tax Computed?

6. What are the Requirements in Filing and Paying of Donor’s Tax?

7. When and Where is the Time and Place of filing and payment of Donor’s Tax

8. What will happen to Donations Transferred for less than the Fair Market Value?

9. What Donations are exempted from Donor’s Tax?

1. What is the New Rate of Donor’s Tax in the Philippines?

Starting January 1, 2018,

The new donor’s tax in Philippines shall be six percent (6%) of the total NET GIFTS in excess of Two Hundred Fifty Thousand Pesos (P250,000) exempt gift made during the calendar year.

When it comes to receiving a mortgaged property, you need to deduct the mortgage in the Fair market Value (FMV) of the Property in order to arrive at the NET GIFT.

2. Is Donation during Election Campaign subject to Donor’s Tax in Philippines?

Contributions given during election campaign are not subject to donor’s tax.

However, campaign contributions net of the candidate’s campaign expenditures, shall be considered as subject to income tax of the political candidate.

In addition to that, campaign expenditures shall be subject to a five (5%) Creditable Withholding Tax (CWT).

Reference: RMC 30-2016.

In addition to that, corporations, especially financial institutions, public utility and exploiter of natural resources are prohibited to donate during the election period.

Reference: Corporation Code of the Philippines and Omnibus Election Code

3. When is the Donation of an Immovable Property valid?

In order that the donation of an immovable property to be valid, it must be made in a public document like Deed of Donation, and shall take effect during the lifetime of the donor.

The donor’s tax shall not apply unless and until there is a completed gift. A gift becomes complete when either:

(1) the donor renounces the powers; or

(2) his right to exercise the reserved power ceases.

4. When is the Valuation Date of the Donation Made?

The reckoning point of valuation shall be the date when the donation is made.

5. How is Donor’s Tax in Philippines Computed?

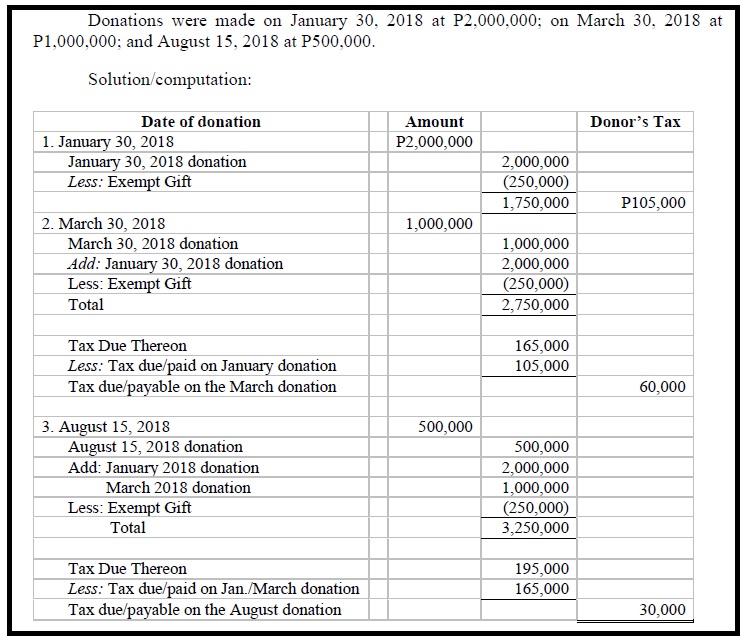

Below is the sample of how Donor’s Tax is computed.

6. What are the Requirements in Filing and Paying of Donor’s Tax in Philippines?

File a separate donor’s tax return in triplicate for each donation made on different dates. Only one return shall be filed for several donations on the same date.

The return shall set forth:

1. Each gift made during the calendar year.

2. The deductions claimed and allowable.

3. Any previous gift made during the same calendar year.

4. The name of the done; and

5. Such further information as the Commissioner may require.

If the donation involves conjugal/community property, each spouse shall file separate return corresponding to his/her respective share in the conjugal/community property.

This rule shall likewise apply in the case of co-ownership over the property being donated.

7. When and Where is the Time and Place of filing and payment of Donor’s Tax in Philippines

The donor’s tax return shall be filed and paid within thirty (30) days after the date the gift is made or completed.

The return shall be filed and paid at the AAB or RDO having jurisdiction over the place where the donor is domiciled at the time of transfer.

In case the gifts made by a non-resident, the return may filed with the Philippine Embassy or Consulate in the country where he is domiciled at the time of the transfer or directly with the RDO No. 39 – South Quezon City.

8. What will happen to Donations Transferred for less than the Fair Market Value?

When the property is transferred less than the fair market value (FMV), the difference shall be deemed as a gift and shall be included in computing the donor’s tax.

However, when transfer of property made in the ordinary course of business and free from donative intent, will be considered as made for an adequate consideration.

9. What Donation are exempted from Donor’s Tax in Philippines?

The following are exempt from donor’s tax:

- Gifts made to or for the use of the National Government.

- Gifts in favor of an educational and/or charitable, religious, cultural or social welfare corporation, institution, accredited nongovernment organization, trust or philanthropic organization or research organization. Provided that,

a. Not more than thirty (30%) of said gifts shall be used by such done for administration purposes.

b. The non-stock entity shall pay no dividend,

c. Governed by trustees who receive no compensation, and

d. Devoting all its income to the accomplishment and promotion of the purposes enumerated in its Articles of Incorporation.

In order to be exempt from donor’s tax and to claim full deduction given to qualified-donee institutions duly accredited,

- The donor engaged in business shall give Notice of Donation on every donation worth at least Fifty Thousand Pesos (P50,000)

- To the Revenue District Office (RDO) which has jurisdiction over the place of business within 30 days after receipt of the qualified donee of the Certificate of Donation,

- Which shall be attached to the said Notice of Donation, stating that not more the thrity (30%) of the said donation/gifts for the taxable year shall be used for administration purpose.

If you want to get a checklist of documentary requirements in Donor’s Tax, click here.

Reference:

Consolidated Revenue Regulations on Estate Tax and Donor’s Tax Incorporating the Amendments Introduced by TRAIN Law (RR 12-2018)

What’s Next?

If you have questions and comments regarding tax, accounting, and business registrations, you can contact us here.